Our tech ecosystem is buzzing with activity as African startups increasingly confront a pivotal question: equity or debt funding? On January 21, 2026, a report highlighted the growing need for entrepreneurs to carefully assess their options, considering business stage, growth ambitions, and crucially, cash flow realities. This isn’t merely a financial decision; it’s a strategic one that will shape the future of innovation across our continent.

Navigating the Early Stages: Why Equity Often Prevails

For startups in their nascent stages, equity funding frequently emerges as the more viable path. Often, these ventures haven’t yet established consistent revenue streams, making debt repayment challenging. Equity allows founders to access capital in exchange for ownership, aligning investor incentives with the company’s long-term success. We’ve seen this play out with numerous early-stage companies backed by investors like TLcom, who prioritize potential over immediate returns. This approach is particularly crucial in sectors requiring significant upfront investment, like agritech or renewable energy.

Debt's Rising Appeal as Startups Mature

However, the landscape shifts as companies mature and demonstrate profitability. Debt financing, offering lower dilution of ownership, becomes increasingly attractive. A startup with predictable cash flow can leverage debt to fund expansion without relinquishing control. The report suggests that as African businesses scale – mirroring the success of companies like Flutterwave – they will likely explore debt options to accelerate growth. Local banks, alongside development finance institutions, are beginning to offer more tailored debt products for the tech sector.

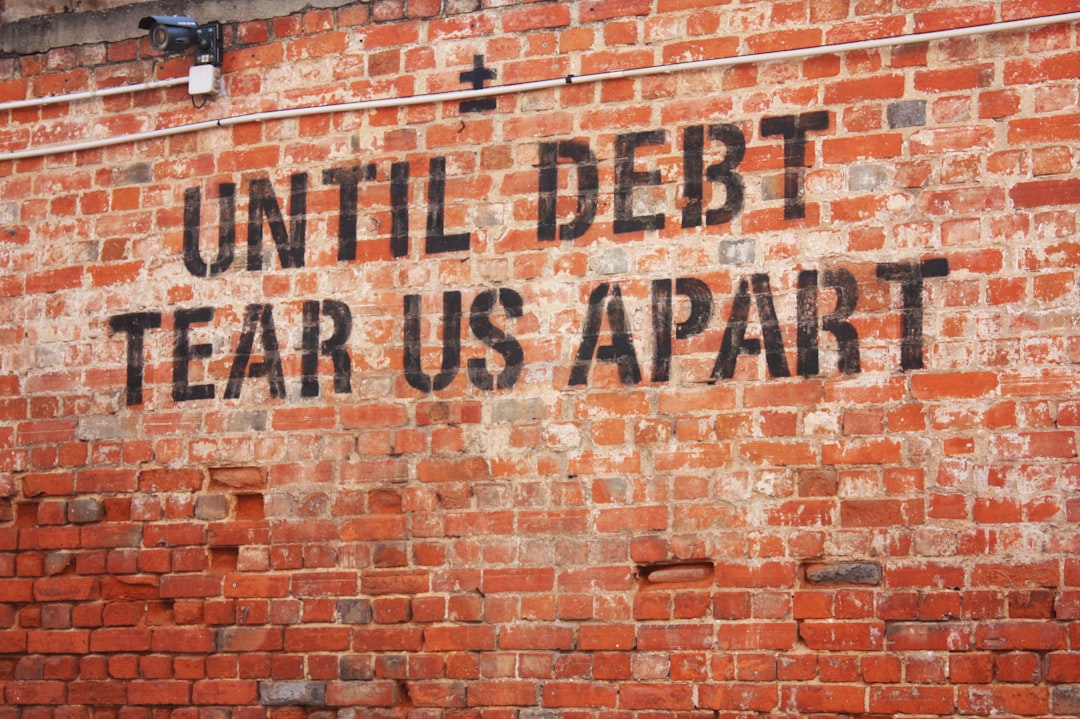

The Cash Flow Imperative: A Key Differentiator

The core of the equity versus debt debate, according to the report, lies in cash flow management. Startups anticipating rapid growth and potentially volatile revenues may find equity’s flexibility more appealing. Conversely, businesses with stable earnings can confidently manage debt obligations. This is a lesson learned from the widespread adoption of mobile money, exemplified by M-Pesa in Kenya, which initially benefited from patient equity investment before achieving sustainable profitability. Understanding this dynamic is paramount for our entrepreneurs.

Looking Towards 2027: A Diversified Funding Future

The future of funding for African startups isn’t about choosing one over the other, but about strategically blending both. We anticipate a more sophisticated financial ecosystem in 2027, with increased availability of both equity from firms like Partech and Norrsken, and tailored debt products denominated in local currencies like the NGN, KES, and ZAR. This diversification will empower our innovators to build sustainable, impactful businesses, driving economic growth and solidifying Africa’s position as a global tech hub.